Accrued expenses are expenses that you’ve already incurred and need to account for in the current month, though they won’t be paid until the following month. Both short-term and long-term liabilities include several types of liabilities which you will need to become familiar with in order to record them properly. Many first-time entrepreneurs are wary of debt, but for a business, is various account liability? having manageable debt has benefits as long as you don’t exceed your limits. Read on to learn more about the importance of liabilities, the different types, and their placement on your balance sheet. Maintaining high liquidity is crucial for covering short-term liabilities, ensuring that a company has sufficient cash and assets that can be readily converted into cash.

What Are Liabilities? (Definition, Examples, and Types)

She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate. Our popular accounting course is designed for those with no accounting background or those seeking a refresher.

How does a liability account differ from an asset account in accounting?

- But a COA in disarray—or no COA at all—can quickly lead to inaccuracies that harm your operations and financial strength.

- Companies might try to lengthen the terms or the time required to pay off the payables to their suppliers as a way to boost their cash flow in the short term.

- Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

- Deciding when to fire an employee requires careful consideration and a clear understanding of how their actions impact the team and company …

- Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design.

- Though not used very often, there is a third category of liabilities that may be added to your balance sheet.

Liabilities are incurred in order to fund the ongoing activities of a business. These obligations are eventually settled through the transfer of cash or other assets to the other party. Unearned Revenue – Unearned revenue is slightly different from other liabilities because it doesn’t involve direct borrowing. Unearned revenue arises when a company sells goods or services to a customer who pays the company but doesn’t receive the goods or services. The company must recognize a liability because it owes the customer for the goods or services the customer paid for.

What is the Definition of Liabilities?

Examples of liability accounts that display on the Balance Sheet include Accounts Payable, Sales Tax Payable, Payroll Liabilities, and Notes Payable. Fixed assets, or non-current assets, are tangible assets with a life span of at least one year and usually longer. HighRadius offers a cloud-based Record to Report Suite that helps accounting professionals streamline and automate the financial close process for businesses. We have helped accounting teams from around the globe with month-end closing, reconciliations, journal entry management, intercompany accounting, and financial reporting. Liabilities are the financial commitments and debts that a firm or individual owes to others, and they are critical to understanding the financial health and stability of the organization. In conclusion, proper recognition and measurement of liabilities are essential for maintaining accurate and transparent financial statements.

This line item is in constant flux as bonds are issued, mature, or called back by the issuer. Listed in the table below are examples of current liabilities on the balance sheet. We will discuss more liabilities in depth later in the accounting course. With FreshBooks expense tracking software, companies can create and categorize expenses, monitor spending, and generate reports to stay on top of their finances. This can help businesses make informed financial decisions and keep on top of their expenses.

- Liabilities play a crucial role in a company’s financial health, as they fund business operations and impact the company’s overall solvency.

- The amount of short-term debt as compared to long-term debt is important when analyzing a company’s financial health.

- Liabilities are categorized as current or non-current depending on their temporality.

- Current liabilities can include things like accounts payable, accrued expenses and unearned revenue.

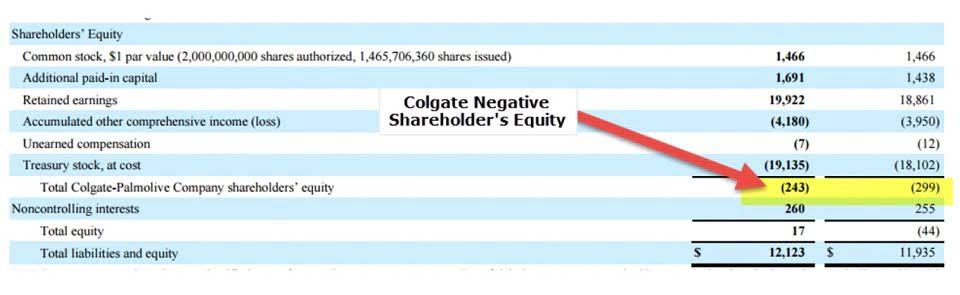

- As you can see, owner or shareholder equity is what is left over when the value of a company’s total liabilities are subtracted from the value of its assets.

Common Types of Liabilities

Because chances are pretty high that you’re going to have some kind of debt. And if your business does have debt, you’re going to have liabilities. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

- Liabilities are future financial obligations for which a company is accountable, while expenses are accounting records of money spent during a specific period to earn revenue.

- It involves anticipating future financial obligations and employing strategies to meet them while maintaining solvency.

- In financial accounting, a liability is a quantity of value that a financial entity owes.

- Did you know that there are several types of accounts in accounting?

Nejnovější komentáře