Forex trading has undergone a significant transformation in the last decade, transitioning from traditional trading methods to increasingly sophisticated algorithmic trading strategies. As technology advances and the growth of high-frequency trading (HFT) strategies takes center stage, understanding forex algorithmic trading becomes crucial for traders looking to optimize their performance. forex algorithmic trading Trading Asia is one of the platforms that highlights these advancements, offering resources and insights into this evolving landscape.

What is Forex Algorithmic Trading?

Forex algorithmic trading, often referred to as algo trading, is the process of using computer programs and algorithms to execute trades in the foreign exchange market. These algorithms utilize mathematical models to analyze market data and identify trading opportunities at speeds unimaginable for human traders. By automating the trading process, traders can eliminate emotional factors and execute complex strategies with precision.

The Evolution of Forex Trading

The forex market has always been dynamic, but the advent of technology has transformed the way trades are executed:

- Manual Trading: Initially, forex trading was conducted manually through phone calls and by accessing brokers directly.

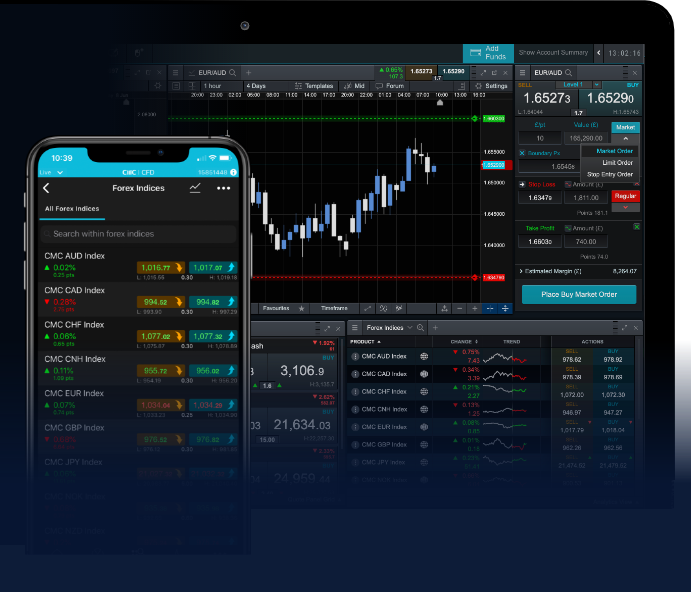

- Electronic Trading Platforms: The rise of online trading platforms like MetaTrader allowed traders to buy and sell currencies more conveniently.

- Algorithmic Trading: Today, traders leverage sophisticated algorithms to analyze market conditions and execute trades at high speed.

Key Components of Forex Algorithmic Trading

There are several essential components that define the success of forex algorithmic trading, including:

1. Trading Strategy

A well-defined trading strategy is fundamental. Common strategies include trend-following, mean reversion, and arbitrage. Whether a trader opts for a simple moving average crossover or a complex neural network model, the choice of strategy should align with their risk tolerance and market conditions.

2. Automated Execution

One of the main benefits of algorithmic trading is the ability to execute trades automatically based on predefined criteria. This can minimize the latency between signal generation and order execution, which is critical in fast-moving markets.

3. Risk Management

Risk management is crucial in forex trading. Algorithms can incorporate various risk management techniques, including stop-loss orders and position sizing adjustments to protect traders from significant losses.

4. Backtesting

Before deploying an algorithm, traders should rigorously test their strategies using historical data. Backtesting helps to assess the viability of a trading algorithm and allows for adjustments based on past performance.

Benefits of Forex Algorithmic Trading

The advantages of algorithmic trading in the forex market are numerous:

- Speed: Algorithms can process information and execute trades in milliseconds, capitalizing on fleeting market opportunities.

- Discipline: Automated systems remove emotional decision-making, ensuring that traders stick to their strategy.

- Backtesting: Traders can validate their strategies against historical market data before risking real capital.

- 24/7 Trading: Algorithms can monitor the market continuously, allowing for trades to be executed even outside traditional trading hours.

Challenges of Forex Algorithmic Trading

Despite its benefits, forex algorithmic trading comes with challenges that traders must navigate:

1. Technical Issues

Automated systems are reliant on technology, and outages or bugs in the software can result in missed opportunities or unexpected losses. A trader must ensure that their technology is robust and reliable.

2. Market Conditions

Algorithms may perform well under certain market conditions but fail during periods of high volatility or unpredictable events. Understanding the market’s current state is vital in determining the continued efficacy of a trading algorithm.

3. Cost

Developing and maintaining a sophisticated trading algorithm can be costly, especially for individual traders. Access to high-quality data feeds, advanced trading platforms, and ongoing costs of servicing the algorithms can add up.

Future of Forex Algorithmic Trading

Looking ahead, the future of forex algorithmic trading seems promising. As artificial intelligence (AI) and machine learning technologies advance, algorithms are expected to become even more predictive. Furthermore, the integration of big data analytics will allow traders to process vast amounts of information and develop more nuanced strategies. The rise of decentralized finance (DeFi) also represents a potential shift in how forex trading may be conducted in the future, expanding access and regulatory frameworks.

Conclusion

In summary, forex algorithmic trading represents a significant leap forward in the trading landscape. By automating processes and leveraging data-driven strategies, traders can maximize their potential in the competitive forex market. While challenges remain, the continual evolution of technology promises exciting opportunities for traders willing to adapt. As we enter this new era of trading, those equipped with the knowledge and tools to harness algorithmic trading will find themselves at a distinct advantage.

Nejnovější komentáře